Cryptocurrency, often referred to as digital currency or virtual currency, has emerged as a revolutionary concept in the financial world. It represents a form of money that operates independently of traditional banking systems and relies on advanced cryptographic techniques for security. This article provides an overview of what cryptocurrency is, its key features, and its impact on the global economy.

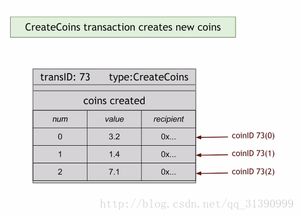

Cryptocurrency is a digital or virtual asset designed to work as a medium of exchange. Unlike traditional fiat currencies, which are issued and controlled by central authorities, cryptocurrencies are decentralized and operate on a technology called blockchain. This blockchain is a distributed ledger that records all transactions across a network of computers.

Several key features distinguish cryptocurrencies from traditional fiat currencies:

Decentralization: Cryptocurrencies operate without a central authority, such as a government or financial institution.

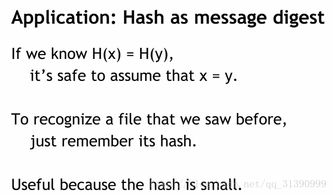

Security: Transactions are secured using cryptographic techniques, making them nearly impossible to hack.

Transparency: All transactions are recorded on the blockchain, which is accessible to anyone, ensuring transparency.

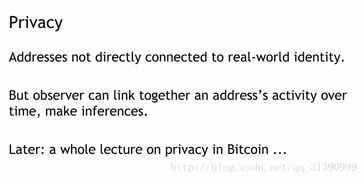

Anonymity: Users can conduct transactions without revealing their personal information, offering a level of privacy.

Scalability: Cryptocurrencies can handle a large number of transactions simultaneously, making them suitable for global use.

The cryptocurrency market is diverse, with various types of digital currencies available:

Bitcoin: The first and most well-known cryptocurrency, Bitcoin was created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto.

Altcoins: Alternative cryptocurrencies that were inspired by Bitcoin but offer unique features or improvements.

Stablecoins: Cryptocurrencies designed to maintain a stable value, often pegged to a fiat currency or a basket of assets.

Smart Contracts: Self-executing contracts with the terms of the agreement directly written into lines of code.

The blockchain is the underlying technology that powers cryptocurrencies. It is a decentralized ledger that records transactions in a secure, transparent, and immutable manner. Each transaction is grouped into a block, which is then added to a chain of previous blocks, forming a chronological record of all transactions.

Cryptocurrency has had a significant impact on various aspects of the global economy:

Financial Inclusion: Cryptocurrencies provide access to financial services for unbanked or underbanked populations.

Investment Opportunities: Cryptocurrencies have become a popular investment asset, attracting both retail and institutional investors.

Disruption of Traditional Financial Systems: Cryptocurrency challenges the traditional banking system by offering a decentralized and transparent alternative.

Innovation: The blockchain technology has sparked innovation in various industries, including finance, healthcare, and supply chain management.

Despite the growing popularity of cryptocurrency, regulatory challenges remain a significant concern. Governments and financial authorities around the world are grappling with how to regulate this emerging asset class without stifling innovation or creating a breeding ground for financial crimes.

Cryptocurrency has the potential to reshape the financial landscape, offering a decentralized, secure, and transparent alternative to traditional fiat currencies. As the technology continues to evolve, it is crucial for individuals and institutions to stay informed about the risks and opportunities associated with this innovative asset class.