As the digital age continues to evolve, cryptocurrencies have emerged as a significant part of the financial landscape. This article delves into the financial trends observed in the cryptocurrency market, providing insights into the factors that influence its dynamics.

Tags: Cryptocurrency, Market Volatility, Financial Trends

One of the most notable characteristics of the cryptocurrency market is its volatility. Prices can skyrocket in a matter of hours, only to plummet just as quickly. This volatility is driven by a variety of factors, including regulatory news, technological advancements, and market sentiment. Understanding these factors is crucial for anyone looking to navigate the cryptocurrency market.

Tags: Cryptocurrency, Regulation, Financial Trends

Regulatory changes have a profound impact on the cryptocurrency market. For instance, the introduction of strict regulations in countries like China and India led to a significant decline in trading volumes. Conversely, countries like El Salvador adopting Bitcoin as legal tender has sparked a surge in interest. The regulatory landscape is constantly evolving, and staying informed about these changes is essential for investors.

Tags: DeFi, NFTs, Cryptocurrency, Financial Trends

Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs) have become increasingly popular in the cryptocurrency space. DeFi platforms offer financial services without the need for traditional intermediaries, while NFTs have revolutionized the digital art and collectibles market. These innovations are expected to drive further growth in the cryptocurrency market.

Tags: Cryptocurrency, Blockchain, Technology, Financial Trends

Underlying the cryptocurrency market is the blockchain technology, which ensures secure and transparent transactions. Advancements in blockchain technology, such as the development of layer-2 solutions, are expected to enhance the scalability and efficiency of cryptocurrency transactions. These technological improvements are crucial for the long-term growth of the market.

Tags: Cryptocurrency, Institutional Investors, Financial Trends

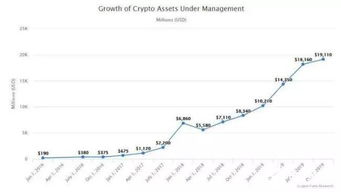

Until recently, the cryptocurrency market was dominated by retail investors. However, institutional investors are now playing a more significant role. The entry of institutional capital has led to increased stability in the market and has contributed to the rise in prices. As more institutional investors recognize the potential of cryptocurrencies, their influence is likely to grow further.

Tags: Cryptocurrency, Global Economy, Financial Trends

The global economic environment also plays a crucial role in shaping cryptocurrency financial trends. Factors such as inflation, currency devaluation, and geopolitical tensions can drive investors towards cryptocurrencies as a hedge against traditional assets. The ongoing COVID-19 pandemic has further highlighted the importance of digital currencies in a globalized economy.

Tags: Cryptocurrency, Financial Trends, Market Outlook

In conclusion, the cryptocurrency market is characterized by its volatility, regulatory changes, technological advancements, and the influence of institutional investors. As the market continues to evolve, it is essential for investors to stay informed about the latest trends and developments. While the future of cryptocurrencies remains uncertain, their potential to disrupt traditional financial systems is undeniable.